Coconut

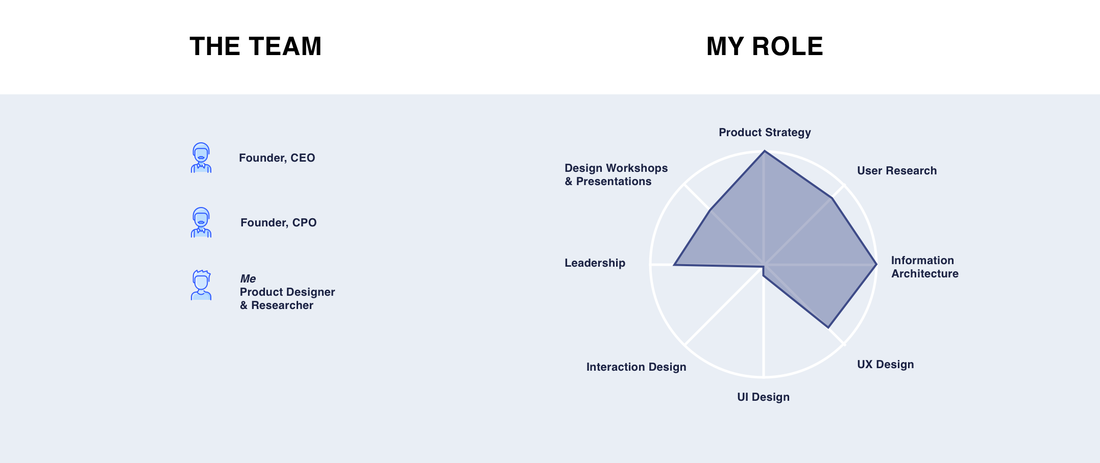

Helped develop the brand strategy and designed the initial MVP for Coconut, a Fintech bank account for self employed professionals

The Problem

Freelancers struggle to manage their money. Depending on the setup of the freelancer they might use one bank account for their personal and their business expenses - this could give them real issues when they come to-do their expenses at the end of the tax year. If the freelancer is a little more organised they might have a separate account for their business, however they might struggle with unexpected tax bills as their current banking provider gives them no indication of how much tax they owe, this normally comes as a big surprise to the freelancer once they go to their bookmaker or accountant at the end of the tax year.

Many freelancers worry they're going about it all wrong, and either not putting enough money for tax aside, or putting too much! Due to this some end up spending far too much on the 'best' accountants, believing if they cost more, they must be more reputable.

Another common problem among freelancers is the shoebox mess of receipts, commonly replaces with the dropbox of screenshots! This behaviour is driven out of fear they might forget a client dinner or lunch they paid for, and not be able to reclaim an expense.

Above all else, freelancers struggle to manage their money as they never know when the next payday will come! Clients don't pay invoices within the allocated time, and often need to be chased...and chased.

Many freelancers worry they're going about it all wrong, and either not putting enough money for tax aside, or putting too much! Due to this some end up spending far too much on the 'best' accountants, believing if they cost more, they must be more reputable.

Another common problem among freelancers is the shoebox mess of receipts, commonly replaces with the dropbox of screenshots! This behaviour is driven out of fear they might forget a client dinner or lunch they paid for, and not be able to reclaim an expense.

Above all else, freelancers struggle to manage their money as they never know when the next payday will come! Clients don't pay invoices within the allocated time, and often need to be chased...and chased.

"The UK’s gig economy has continued to boom well into 2018, with the country now playing home to an estimated 5 million self-employed people. The professional services sector is a major driver of growth in this area in particular, with the number of freelance workers in Britain having reached 2 million since 2001."

-UK CONSULTANCY 2018

-UK CONSULTANCY 2018

Coconut

I first met Sam and Adam, while working for Loot, a student bank account. Sam and Adam were looking for a freelancer product designer who could help them bring their freelance bank account to life. Coconut which was called Monizo back in 2016 when I first met the founding duo, was on a simple mission, to create the idea bank account for freelancers, with HMRC tax integrations, to help them manage their money.

Together we sat down, performed the crazy 8 technique, and formed the following feature roadmap for the MVP.

Together we sat down, performed the crazy 8 technique, and formed the following feature roadmap for the MVP.

MVP Feature Roadmap

The initial offering would include a link to your bank account through true layer or Yodlee. The user would be able to see a daily update of their transactions and view all transactions across their personal and business bank account. These transactions would categories themselves automatically, into categories such as income, tax, expense or personal account to better estimate the tax return for the freelancer. Not only would the MVP have these features, but it would also allow the user to attach receipts using the phone camera, and share receipts to the chosen accounts email address. The key feature of the MVP would be to estimate the users tax, balance and monthly performance of in/out money.

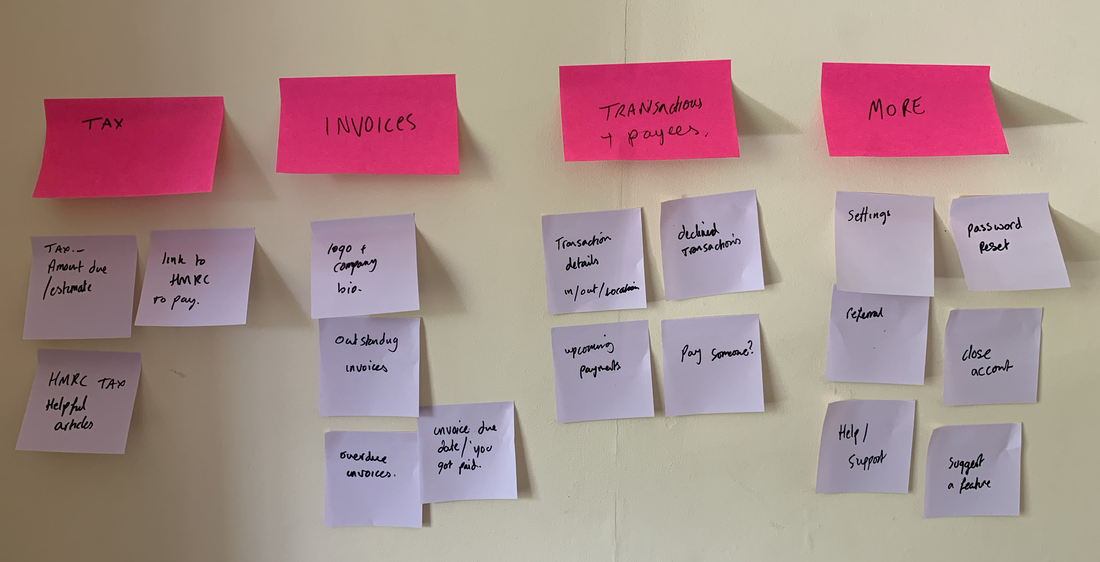

Card Sorting

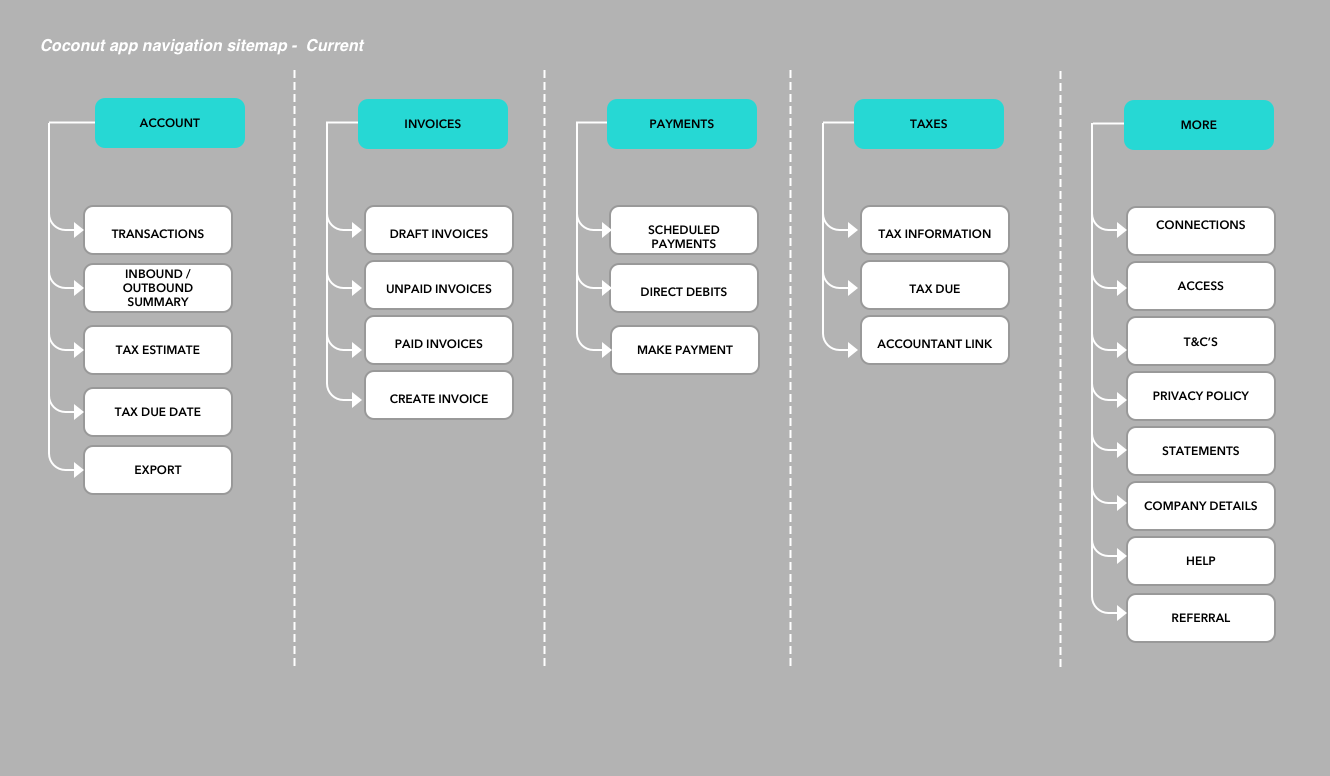

Once we decided on the feature roadmap, myself and the founders began to map out the priorities for the app sitemap. The Coconut team had conducted various research with freelancers and small business owners that fed directly into the card sorting exercise. We began with the three key areas of interest.

-Tax

-Invoices

-Transactions and payments

We began to sort the relevant features that would populate these features. An example of this would be under the Tax tab, there might be an estimate feature, a link to HMRC to pay the tax due, and possible links to helpful tax & VAT related articles.

-Tax

-Invoices

-Transactions and payments

We began to sort the relevant features that would populate these features. An example of this would be under the Tax tab, there might be an estimate feature, a link to HMRC to pay the tax due, and possible links to helpful tax & VAT related articles.

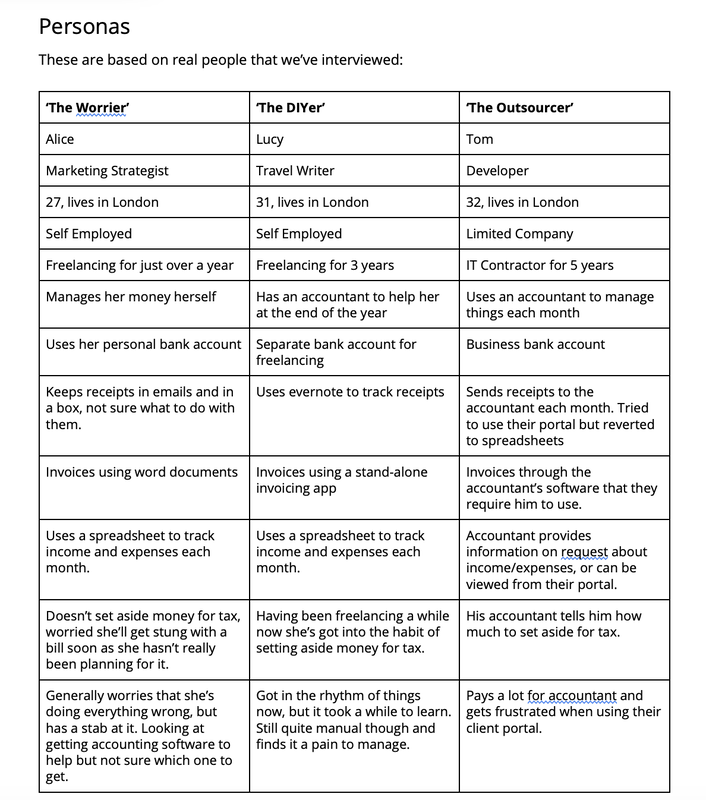

Personas // Target Market

From the research conducted by the Coconut founders, together we identified three distinct persona groups that collectively represent a number of freelancers we affinity mapped. Each persona group had a distinct requirement for a banking product.

1. Worrier - Needs a dedicated business account which provides up to date tax estimates based so she has enough for her tax return.

2. DIYer - Wanted a how to guide or articles to understand the freelance process when getting started. Wants to track receipts easily.

3. Outsourcer - Wants to reduce his accountant dependancy, and reduce expenditure in the process. Wants to track and chase invoices easily.

1. Worrier - Needs a dedicated business account which provides up to date tax estimates based so she has enough for her tax return.

2. DIYer - Wanted a how to guide or articles to understand the freelance process when getting started. Wants to track receipts easily.

3. Outsourcer - Wants to reduce his accountant dependancy, and reduce expenditure in the process. Wants to track and chase invoices easily.

Competitors & Alternate Solutions

Freelancer/Contractor Banking

- Holvi (Finnish payments institution)

- Mycashplus (referral through IPSE, contractor/freelance association)

- Cater Allen (though you can only get it through an intermediary, but it is widely used, eg Coulson Pritchard)

- Xero (has a ‘freelancer package’ = its small business package with a different name (starter) and usage limits)

- Quickbooks self employed (A tailored package for freelancers, web-based in the UK, mobile in US)

- Freeagent (targeted at freelancers and small business owners)

- Invoicing

- Albert - just gone through FinTech Innovation Lab and seeing some traction.

- Receipt Capture

- Shoeboxed - aimed and digitising paper records and storing them

- ReceiptBank - more focused specifically on receipts/invoices and getting them into accounting packages.

- PFM apps

- Qapital - they have launched a freelancers feature to set aside X% of cash for tax.

- Microsoft Excel

- Commonly used for tracking finances and also communicating with accountants.

- Crunch

- Full stack accounting & accounting software company.

- Nixon Williams

- Built their own online accounting platform for contractors/freelancers call Vantage.

- SJD Accountants

- They have 13,000 contractors using their service. They look to be quite old school / no online tools particularly.

Sketching & Wireframing

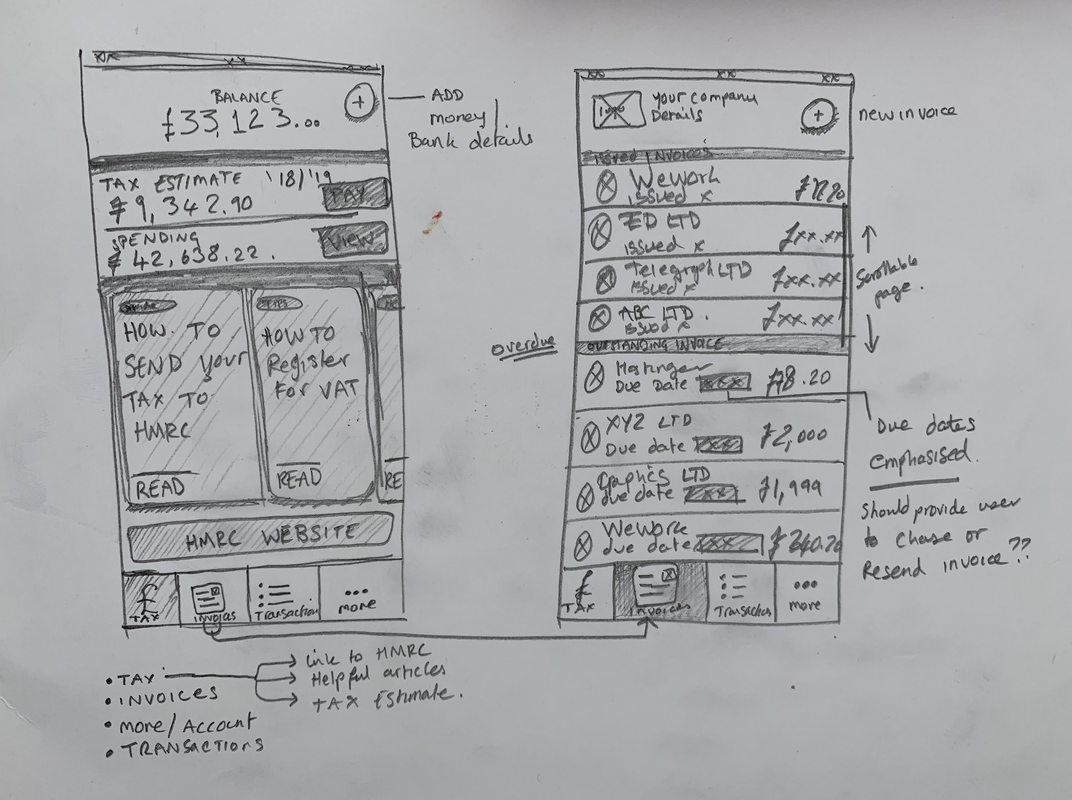

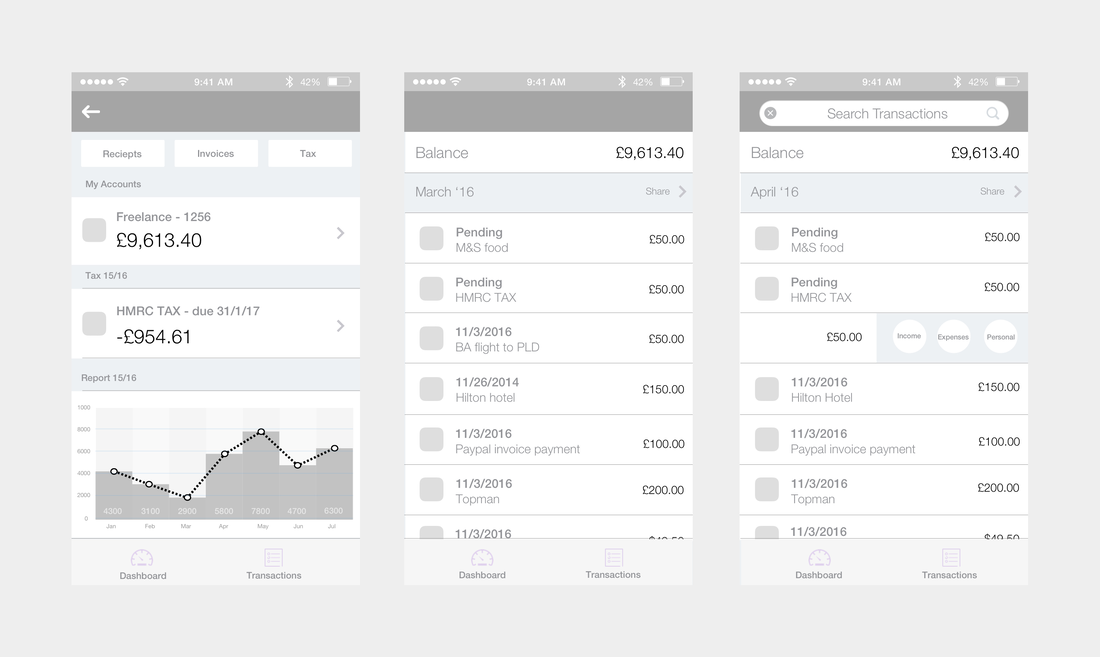

I then begun condensing the sitemap architecture and the ideas we had derived from the personas. Initially I wanted to focus on two key areas that would provide the most value to the three personas, these were the tax estimate, the invoicing functionality, and the blog articles for helping freelancers to understand how they should progress the financial side of their business.

Sitemap

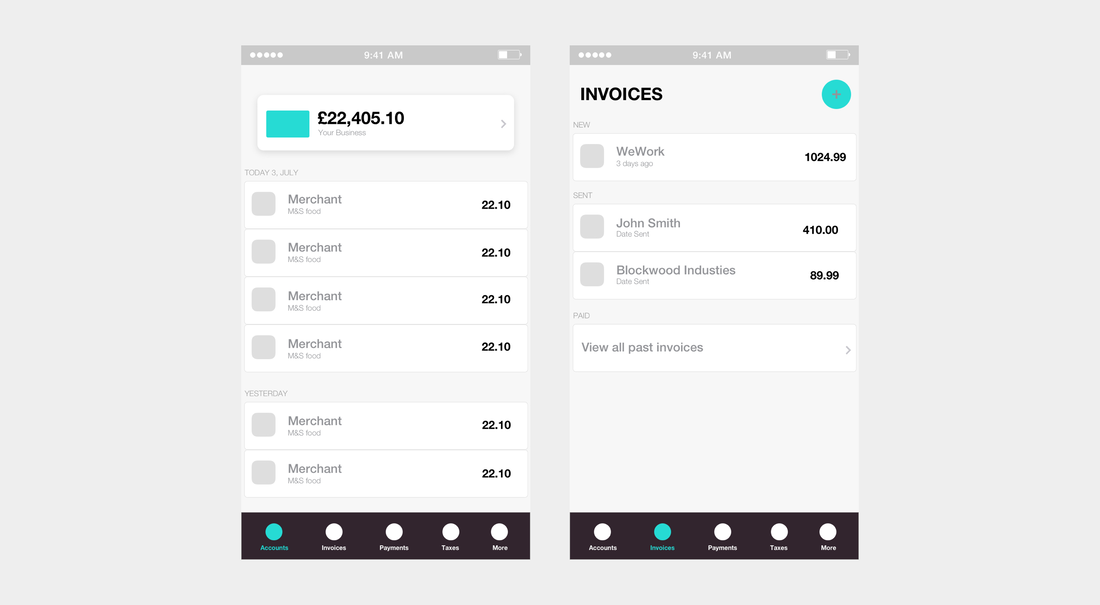

After ideating the initial app content with the two founders, Adam & Sam, I started creating some wireframes to begin to map out the app architecture. Initially we felt the tax due should be a prominent amount showcased on the homepage, but after reviewing our user interviews it became apparent that this amount would change far too regularly due to incoming and outgoing transactions, that this amount was more of a nuisance on the home screen, than a benefit.

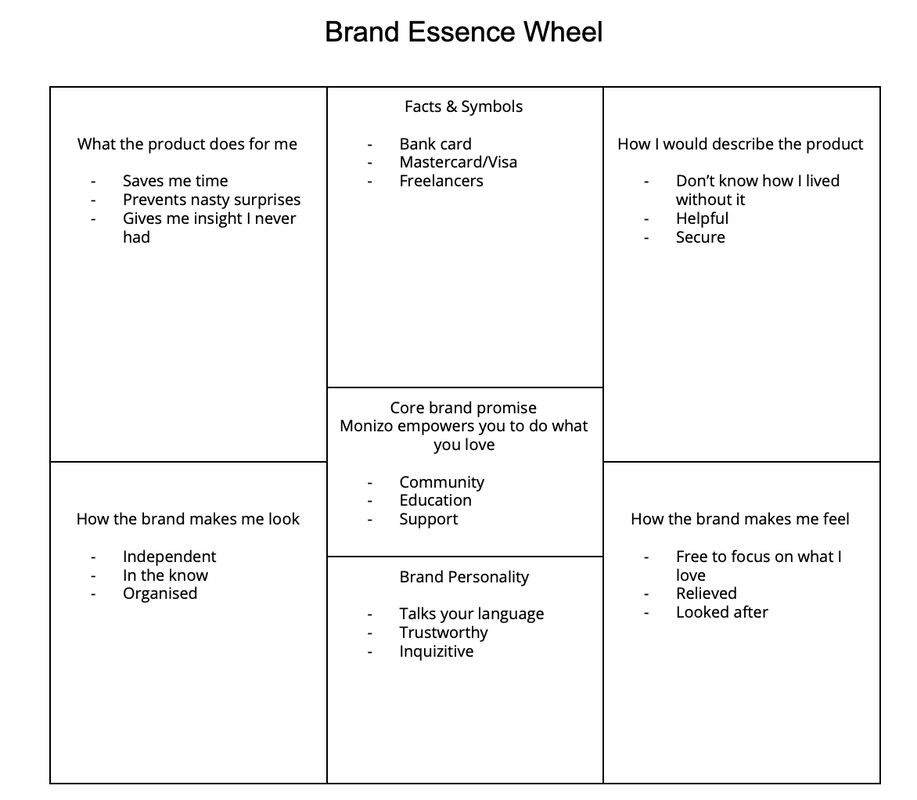

After the initial wireframes had been designed, I was tasked with pushing the design further, looking to some of the competitor design systems to create a unique brand identity for Coconut. We wanted to ensure the application had the space to grow, and not look crowded, drawing inspiration from Revolut and Monzo for the initial UI and Amex for the interaction design.

2.0 Feature Roadmap

Like many good product teams, we then ideated what the version 2.0 features would be, so we could stay on track and ensure investor relations or customer feedback would only enhance our product offering and not stray it from it's end mission.

The future feature development included creating an actual bank account rather than an open banking aggregator or E-money licence bank. For this Coconut would need to follow in Monzo's shoes and start applying for UK banking licence asap as they could take a number of years to obtain.

Real time notifications and transaction updates were something that open banking aggregators hadn't been too good at so far, and this feature had been very well received with competitors and customers so that made it's way up the feature prioritisation for V2.

There are a number of 3rd party apps which offer client invoicing methods, however it would make banking much easier for freelancers and small businesses if they were able to produce, send and track these from directly inside the app.

The next few features were listed as improvements or nice to have rather than must have. They included automating some of the V1 features such as categorisation, including new categories such as travel. The ability to submit tax returns and handle VAT would also be key feature improvements to strengthen the value proposition with V2.0.

The future feature development included creating an actual bank account rather than an open banking aggregator or E-money licence bank. For this Coconut would need to follow in Monzo's shoes and start applying for UK banking licence asap as they could take a number of years to obtain.

Real time notifications and transaction updates were something that open banking aggregators hadn't been too good at so far, and this feature had been very well received with competitors and customers so that made it's way up the feature prioritisation for V2.

There are a number of 3rd party apps which offer client invoicing methods, however it would make banking much easier for freelancers and small businesses if they were able to produce, send and track these from directly inside the app.

The next few features were listed as improvements or nice to have rather than must have. They included automating some of the V1 features such as categorisation, including new categories such as travel. The ability to submit tax returns and handle VAT would also be key feature improvements to strengthen the value proposition with V2.0.

TL;DR

I created the initial roadmap alongside the founders of Coconut. I also designed the initial content wireframes for the MVP.